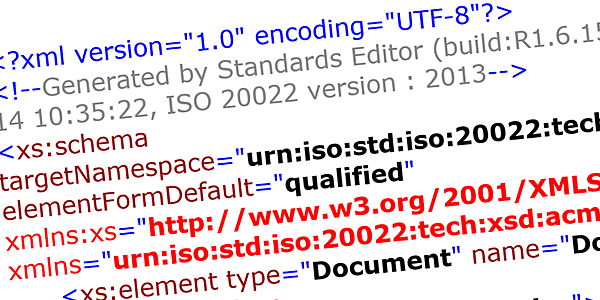

1. Financial messaging (ISO 20022)

First published in 2004, ISO 20022, Financial services – Universal financial industry message scheme, is widely recognized as the standard of the future. Representing international consensus on the way financial messages are structured, it is a key tool in the transformation of the global financial system, underpinning such technologies as instant payment platforms. It features eight parts covering aspects such as XML Schema generation, message transport characteristics and registration.

2. International Bank Account Numbers (IBAN)

International bank transfers work quickly and easily thanks to the universally agreed way of defining and coding international bank account numbers. This is due to ISO 13616, Financial services – International Bank Account Number (IBAN), the ISO standard that specifies everything required to facilitate the processing of data internationally in data exchange, both in financial environments and across other industries.

The standard comes in two parts covering the specifications for the number itself as well as the role, responsibilities and requirements of the Registration Agency responsible for the registry of IBAN formats.

3. Business identifier codes (BIC or SWIFT code)

One of the most widely used codes in the financial world is the BIC code, defined by ISO 9362, Banking telecommunication messages – Business identifier code (BIC). Originally known as the “bank identifier code”, its name was changed to “business” to cover financial or related institutions when the standard was revised in 2009.

For over 30 years, the standard has been used to identify banks and financial or related institutions to facilitate automated processing of information for financial services. ISO designated the Society for Worldwide Interbank Financial Telecommunication (SWIFT) as the BIC registration authority, hence the names BIC and SWIFT codes are often used interchangeably.

4. Market identification codes (MIC)

Trading on international stock exchanges such as the NASDAQ is possible thanks to MIC codes defined by ISO 10383, Securities and related financial instruments – Codes for exchanges and market identification (MIC). Used to identify securities trading exchanges, the MIC code has wide acceptance in the financial world, including the Financial Information eXchange (FIX) protocol, which is an electronic communications protocol for the international real-time exchange of information related to securities transactions and markets.

The standard specifies a universal method of identifying exchanges, trading platforms, regulated or non-regulated markets and trade reporting facilities as sources of prices and related information in order to facilitate automated processing.

5. Messaging in securities

Before standardization, messaging used in transactions between financial institutions was ad hoc and inconsistent, resulting in inefficiencies and the risk of errors. The two-part ISO 15022, Securities – Scheme for messages (Data Field Dictionary), sets out the principles necessary to provide the different communities of users with tools for designing message types to support their specific information flows. This results in greater efficiencies, more clarity and less risk.

The two-part standard covers message design rules and guidelines and the maintenance of such data and messages. Updates to the standards have focused on improving straight-through processing capabilities and reducing the time taken to deliver new message types to the marketplace.